Joint home loan tax benefit calculator

The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Unbeatable Mortgage Rates for 2022.

Joint Property Income Tax Rules On Home Loan Explained Mint

And in a joint home loan both the.

. A home loan tax benefit calculator is an online tool that allows you to compute how much taxes you can save because of your housing loan. 15 lakh and under Section 24 you can save taxes up to Rs. Tax Benefit on Joint Home Loan.

First choose the applicable customer type. Our home loan tax benefit calculator enables you to get an estimate of the amount of tax that you can save by claiming deductions as per the Income Tax act. Here are the steps to follow.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Total Income Tax Benefit 105000. Both co-applicants can apply for income tax benefits towards both principle re-payment and interest income.

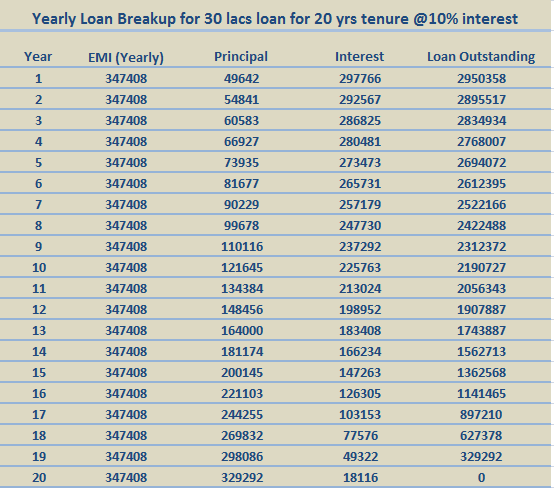

2 Enter your basic details. The amount paid towards interest will be in proportion to the percentage ownership of each co-applicant. As per the Income Tax Act 1961 you can receive tax benefits on both home loan components ie.

Regular or Senior citizen Then enter your gross annual income and the principal and interest paid on the home loan for the year in the respective fields Lastly click on Calculate. Here is how co-applicants stand to gain through a Joint Home Loan. Ad Work with One of Our Specialists to Save You More Money Today.

The calculator is simple and has an easy-to-use interface. Claim a maximum home loan tax deduction of up to 15 Lakh from your taxable income on the principal repayment. Kotak Mahindras Home Loan Tax Benefit Calculator helps you determine the exact amount to be paid after all the eligible tax deductions.

Tax break on repayment of your principal amount under Section 80C and tax deductions on interest payment under Section 24 of the Income Tax Act. Usually under Section 80C you can claim tax deduction up to Rs. Second your eligibility for the home loan also increases.

Ad Best Home Loan Mortgage Rates. Calculating home loans has never been easier. Joint Loan Income Tax Benefits are as follows.

Compare Offers Apply. Bajaj Finserv tax saving calculator helps you to understand income tax benefits before and after taking a home loan. Co-applicants and co-owners can claim up to a maximum of Rs200000 on the interest component of the Home Loan repayment amount paid that year.

These benefits include. Ad Discover Helpful Information And Resources On Taxes From AARP. The tax benefits are also greater in the case of a joint home loan.

Use home loan tax benefit calculator now. 1 Click on the Apply Now option on the webpage. Use home loan tax benefit calculator now.

The total deduction for the interest paid will be allocated between all co-owners based on the ratio of ownership. Total Income Tax Benefit 105000. Keep in mind that you can claim tax deductions separately on principal repayment and interest payment within a financial year.

Calculate Your Rate in 2 Mins Online. Every co-applicant is eligible for taking these tax benefits. How to apply for a joint home loan with Bajaj Finserv.

Get Pre-Qualified in Seconds. Each co-applicant can claim a tax deduction of up to Rs 2 lakh for interest payments and Rs 15 lakh for principal repayment under Section 24b and. Ad Best Home Loan Mortgage Rates.

This may include stamp duty and registration charges as well but can be claimed only once. Our home loan tax benefit calculator enables you to get an estimate of the amount of tax that you can save by claiming deductions as per the Income Tax. To know your benefits via a home loan tax saving calculator simply follow these 3 steps.

Additionally borrowers with joint home loans are eligible for joint home loan tax exemptions which means you and all your co-borrowers or co-applicants can claim income tax benefits separately. Each co-applicant can claim joint housing loan tax benefits for the payment of interest up to Rs. In India tax benefits are offered on two components of the home loan - interest repayment and principal amount.

This simple home loan tax benefit calculator will help you determine the tax saving opportunity that you can be eligible for on your home loan. Enjoy maximum deductions of up to 2 Lakh on the interest amount payable. View Payments Report.

While you can apply offline it is a lot quicker to fill the easy online application form and apply online. Hence a total of Rs4 lakhs can be claimed as a deduction. 2 lakhs under Section 24 of the Income Tax Act.

All you have to do is enter the following details in the designated fields of the calculator. The tax benefits are also greater in the case of a joint home loan. As a result each owner receives a portion of the total interest paid on the loan.

Under section 24 b the maximum tax benefits on home loan for joint owners is upto INR Rs 200000 on the amount paid towards the interest as per their ITR statements. Tax Benefits on Joint Home Loan The maximum interest deduction for a self-occupied property is Rs 2000000 per co-owner who is also a co-applicant. Being an automated tool the calculator weighs in all the elements to calculate the amount such as gross annual income home loan interest rate principal.

Alert Message My Account. You can use the Home Loan Tax Saving Calculator on Bajaj MARKETS to calculate the total tax benefit that you can get on your home loan. The principal and interest amount.

3 Verify your identity by entering the OTP sent to your mobile.

How To Make Your Home Loan Interest Free Here Is The Solution

Nris Can Apply For Home Loans Separately Or Jointly All Proposed Buyers Of The Home Will Have Their Co Appl Renting A House Selling Your House Rental Property

Home Loan Eligibility Calculate Home Loan Eligibility Online

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022 23 Youtube

Gncwr6a5kv4kum

How To Avail Tax Benefits On A Joint Home Loan 3 Possible Ways

Home Loan Tax Benefit Tax Saving Under Section 24 80ee 80c

Impact Of Emi Moratorium On Home Loan Tax Deductions Housing News

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022 23 Youtube

Home Loans Tax Benefits Forbes Advisor India

Axis Bank Home Loan Calculator 2021 Calculate Axis Bank Home Loan Emi Online

What Would Happen If I Pay More Than The Stipulated Emi Of My Home Loan All Of A Sudden Quora

How To Claim Tax Benefits On Home Loan Idfc First Bank

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022 23 Youtube

Home Loan Emi S Principle And Interest Breakup With Emi Calculator

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022 23 Youtube

Pros And Cons Of A Joint Home Loan For Married Couples Tata Capital Blog